The Importance of Financial Wellness in the Workplace

Understanding Financial Wellness

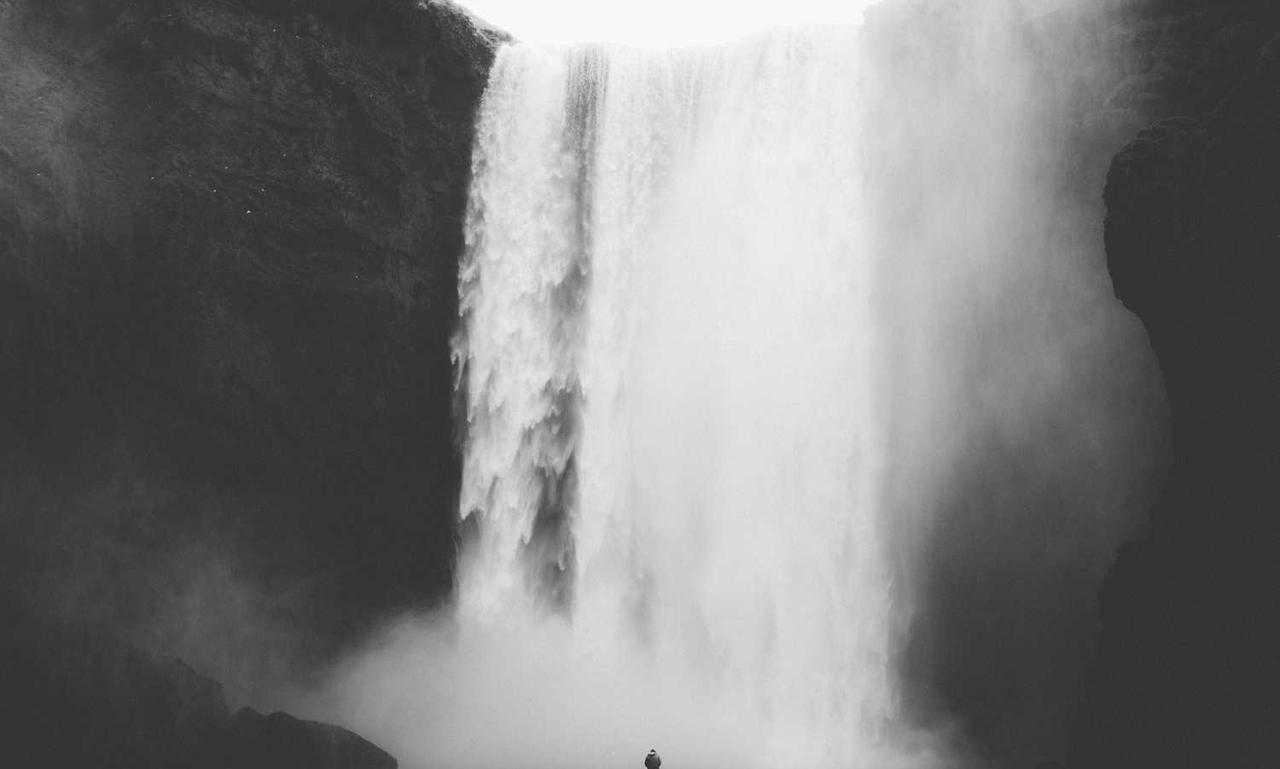

- Financial wellness in the workplace refers to the overall monetary well-being of employees. It’s about having the knowledge, skills, and confidence to make informed financial decisions. When employees are financially well, they can effectively manage their finances, reduce stress related to money matters, and focus better on their work responsibilities. By promoting financial wellness, employers empower their workforce to achieve financial stability and security, leading to a more engaged and productive team.

The Impact on Employee Productivity and Satisfaction

- Financial wellness significantly impacts employee productivity and satisfaction in the workplace. When employees are financially secure, they are less distracted by money problems, leading to increased focus and productivity at work. Moreover, offering financial wellness programs demonstrates that employers care about their employees’ holistic well-being, which can enhance job satisfaction and loyalty. Employees feel valued and supported, fostering a positive work environment that boosts morale and retention rates. Overall, investing in financial wellness programs is a strategic approach to creating a healthier and more prosperous work environment for all.

Key Components of a Financial Wellness Program

Educational Workshops and Seminars

Engaging employees through educational workshops and seminars is vital for enhancing their financial well-being. By providing access to experts who can educate them on essential financial topics such as budgeting, saving, investing, and retirement planning, organizations empower their employees to make informed decisions. These sessions equip employees with the knowledge and skills needed to take control of their financial futures, leading to reduced financial stress and improved money management capabilities.

Personalized Financial Counseling

Offering personalized financial counseling services as part of a financial wellness program can significantly benefit employees. Through one-on-one sessions with financial experts, employees can receive tailored guidance on managing their finances, setting realistic goals, and overcoming financial challenges. Personalized financial counseling helps employees address their specific financial concerns and develop customized strategies to achieve financial stability, ultimately boosting their overall well-being and productivity.

Access to Financial Planning Tools

Providing employees with access to user-friendly financial planning tools is essential for promoting financial wellness in the workplace. These tools, ranging from budgeting apps to retirement calculators, empower employees to track their expenses, set savings goals, and plan for the future effectively. By incorporating technology-driven solutions into financial wellness programs, organizations enable employees to take control of their financial health conveniently and proactively, fostering a financially secure and empowered workforce.

Implementing Financial Wellness Initiatives

Assessing Employee Needs

- When rolling out financial wellness initiatives in the workplace, it’s crucial to start by assessing employee needs. Conducting surveys or focus groups helps me understand the specific financial challenges my team faces. By gathering feedback directly from employees, I can tailor programs to address their most pressing concerns. This proactive approach ensures that the initiatives implemented are relevant, effective, and well-received by the workforce.

Integrating Programs with Existing Benefits

- Integrating financial wellness programs with existing employee benefits is a strategic way to enhance overall well-being. By incorporating financial education into existing training sessions or wellness programs, I can maximize the reach and impact of these initiatives. Linking financial wellness to benefits like health insurance or retirement plans shows employees that their financial health is a priority for the company. This integration not only increases program visibility but also fosters a holistic approach to employee wellness.

Measuring Success and Program Adoption

- Measuring the success of financial wellness programs is essential to assess their impact and effectiveness. Tracking metrics such as participation rates, engagement levels, and feedback allows me to evaluate the program’s performance and make data-driven decisions for improvement. Monitoring program adoption rates also provides insights into the overall effectiveness and relevance of the initiatives. By analyzing these key indicators, I can continuously refine and enhance financial wellness programs to better meet the needs of employees and drive positive outcomes.

Case Studies: Success Stories of Financial Wellness Programs

1. Company-Wide Financial Wellness Initiatives

In my experience, implementing company-wide financial wellness initiatives can have a profound impact on employees’ well-being and productivity. One notable success story involved a large corporation that introduced a comprehensive financial wellness program for its workforce. The program featured a mix of educational workshops, one-on-one financial counseling sessions, and easy-to-use budgeting tools. By offering a range of resources tailored to different learning styles and financial needs, the company was able to engage employees effectively.

2. Small Business Financial Empowerment Success

Sharing another remarkable case, a small business implemented financial empowerment strategies with outstanding results. This business provided financial literacy training sessions and incentives for employees to participate in saving and investment programs. The owners also organized regular check-ins to track progress and offer support. As a result, employees demonstrated improved money management skills, increased savings rates, and enhanced financial confidence. This holistic approach to financial empowerment significantly contributed to the overall success and satisfaction of the small business workforce.

Challenges and Best Practices

Overcoming Common Barriers to Implementation

When aiming to implement financial wellness programs in the workplace, certain common barriers can hinder success. One challenge often faced is resistance from employees who may be reluctant to discuss personal finances openly. To overcome this barrier, providing a safe and confidential environment for employees to engage with financial resources is essential. By creating a culture of trust and support, employees are more likely to participate actively in the programs.

Another hurdle is the lack of awareness or understanding of the benefits of financial wellness initiatives. To address this, it’s crucial to educate employees about the positive impacts these programs can have on their overall well-being and financial stability. Clear communication about the goals and value of such initiatives can help garner buy-in from employees at all levels within the organization.

Tips for Encouraging Employee Participation

To boost employee participation in financial wellness programs, companies can implement various strategies. Offering incentives such as rewards or recognition for engagement can motivate employees to take part in workshops or counseling sessions. Additionally, making these programs easily accessible through online platforms or mobile apps can enhance convenience and encourage more widespread participation.

Moreover, creating a supportive community around financial wellness within the workplace can foster a sense of camaraderie and mutual encouragement. Encouraging peer-to-peer discussions or setting up support groups where employees can share experiences and tips for better money management can increase engagement and sustain long-term participation.

By addressing common barriers proactively and implementing employee-centered strategies, companies can successfully empower their workforce for better money management and overall financial well-being.